BUILDING OPPORTUNITY FUND

FREQUENTLY ASKED QUESTIONS

What is The Building Opportunity Fund?

The Building Opportunity Fund is a special fund set aside to prepare for our future home. This will be used to either renovate and lease a new space or purchase and renovate a new space.

How can I contribute?

You can give online and select 'Building Opportunity Fund' in the dropdown menu. You can also write a check and write 'Building Opportunity Fund' in the memo line. Gifts to the Building Opportunity Fund will only be used for this purpose.

What is wrong with our current space?

We love our current location and are so grateful that God has provided it for us. Our current lease runs through October 31, 2024. While renewing our lease in this current space is an option, our current pace of growth suggests that staying in our current building will most likely hinder growth.

How will the Building Opportunity Funds be used?

We have listed three options: good, better and best. The good option involves renovating and leasing a new space. We estimate this will require an investment of $2.25 million. The better option involves purchasing a building and renovating it through financing a loan. We estimate this will require a total amount of $6.75 million with a downpayment of $1.7 million. The best option involves purchasing a building and renovating it with cash. This would an estimated investment of $6.75 million.

When is the target date to complete fundraising?

We hope to have the funds we need in place by January 1, 2024. This allows us time to negotiate a lease or purchase a building before our current lease is up.

What if sufficient funds are not raised by that date?

We will seek to renew our lease in our current building for another three years and make necessary adjustments to continue to accommodate growth (i.e. go to two services, plant another church, etc.).

Why is the church willing to take on debt?

Our current lease is actually a form of debt. We are legally obligated to pay through the term of the lease. In this sense, being willing to take on a loan is not that much different. In some cases, this may even mean our monthly mortgage payment would actually be less than our monthly rent payment. Our goal is to follow the wisdom of church finance experts by putting 20% down as a down payment and by keeping our annual mortgage payments around 30% of our annual budget.

What is your plan for promoting this fund?

You could call this a 'soft' building campaign. We do not want to pressure people and are not planning to ask for specific commitments from the whole congregation at this time. If you feel led to give above and beyond your normal giving, we welcome that!

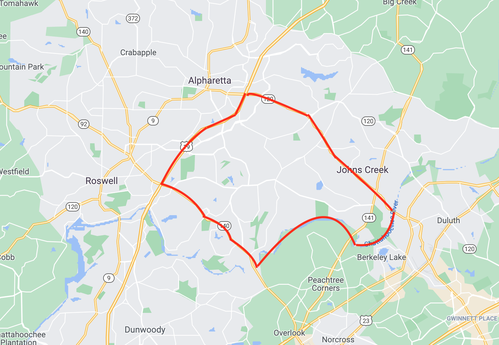

What is the target area for a new building?

We would like to be at or north of Holcomb Bridge Road, at or south of Old Milton Parkway, east of 400 and west of the Chattahoochee River.

The Building Opportunity Fund is a special fund set aside to prepare for our future home. This will be used to either renovate and lease a new space or purchase and renovate a new space.

How can I contribute?

You can give online and select 'Building Opportunity Fund' in the dropdown menu. You can also write a check and write 'Building Opportunity Fund' in the memo line. Gifts to the Building Opportunity Fund will only be used for this purpose.

What is wrong with our current space?

We love our current location and are so grateful that God has provided it for us. Our current lease runs through October 31, 2024. While renewing our lease in this current space is an option, our current pace of growth suggests that staying in our current building will most likely hinder growth.

How will the Building Opportunity Funds be used?

We have listed three options: good, better and best. The good option involves renovating and leasing a new space. We estimate this will require an investment of $2.25 million. The better option involves purchasing a building and renovating it through financing a loan. We estimate this will require a total amount of $6.75 million with a downpayment of $1.7 million. The best option involves purchasing a building and renovating it with cash. This would an estimated investment of $6.75 million.

When is the target date to complete fundraising?

We hope to have the funds we need in place by January 1, 2024. This allows us time to negotiate a lease or purchase a building before our current lease is up.

What if sufficient funds are not raised by that date?

We will seek to renew our lease in our current building for another three years and make necessary adjustments to continue to accommodate growth (i.e. go to two services, plant another church, etc.).

Why is the church willing to take on debt?

Our current lease is actually a form of debt. We are legally obligated to pay through the term of the lease. In this sense, being willing to take on a loan is not that much different. In some cases, this may even mean our monthly mortgage payment would actually be less than our monthly rent payment. Our goal is to follow the wisdom of church finance experts by putting 20% down as a down payment and by keeping our annual mortgage payments around 30% of our annual budget.

What is your plan for promoting this fund?

You could call this a 'soft' building campaign. We do not want to pressure people and are not planning to ask for specific commitments from the whole congregation at this time. If you feel led to give above and beyond your normal giving, we welcome that!

What is the target area for a new building?

We would like to be at or north of Holcomb Bridge Road, at or south of Old Milton Parkway, east of 400 and west of the Chattahoochee River.